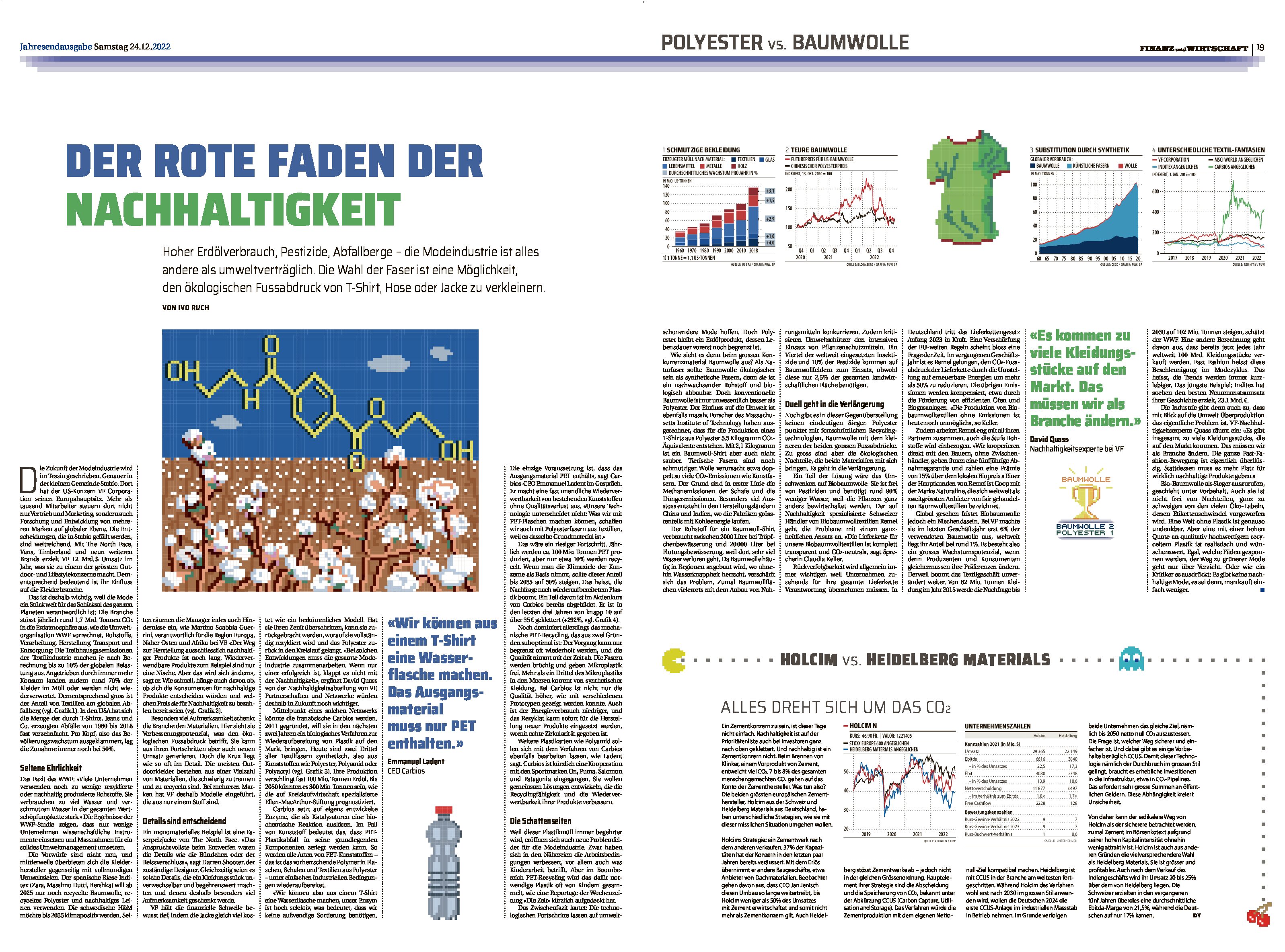

Polyster vs. cotton: “Tagesanzeiger” and “Finanz und Wirtschaft” about Remei and the solution that lies in switching to organic cotton

to the article in the “Tagesanzeiger”

to the article in the year-end edition “Finanz und Wirtschaft”

Many thanks to Ivo Ruch for addressing the possibility of reducing the ecological footprint of a T-shirt, trousers or jacket through the choice of fibre:

Polyester scores with advanced recycling technologies, cotton with the smaller of the two big footprints. But the ecological disadvantages of both materials are too great. Part of the solution would be to switch to organic cotton. It is free of pesticides and requires about 90% less water because the plants are cultivated in a completely different way.

Remei, a Swiss trader of organic cotton textiles specialising in sustainability, takes a holistic approach to the problems.

“The supply chain for our organic cotton textiles is completely transparent and C02-neutral,” says spokesperson Claudia Keller.

Traceability is becoming more and more important in general, because companies increasingly have to take responsibility for the entire supply chain. In Germany, the Supply Chain Act will come into force at the beginning of 2023. A tightening of the EU-wide rules seems to be just a matter of time.

In the past financial year, Remei succeeded in reducing the supply chain’s C02 footprint by more than 50% by switching to renewable energy. The remaining emissions are offset, for example by promoting efficient stoves and biogas plants.

“Producing organic cotton textiles without emissions is still impossible today,” says Keller.

In addition, Remei works closely with all its partners, including the raw material level.

“We cooperate directly with the farmers, give them a five-year purchase guarantee and pay a premium of 15% above the local market price.”

One of Remei’s main customers is Coop with its naturaline brand, which claims to be the world’s second-largest supplier of fair-trade organic cotton textiles.

Globally, however, organic cotton ekes out a niche existence. At VF, it accounted for only 6% of the cotton used in the last business year; worldwide, its share is around 1%.

So there is great potential for growth if producers and consumers alike change their preferences.